I've found that if you have a small business that is registered for GST, and one that is new, you often don't have your accounting package set up yet (e.g. Xero). With minimal transactions and no complex activities, sometimes it doesn't make sense to pay for the accounting package until it is really needed.

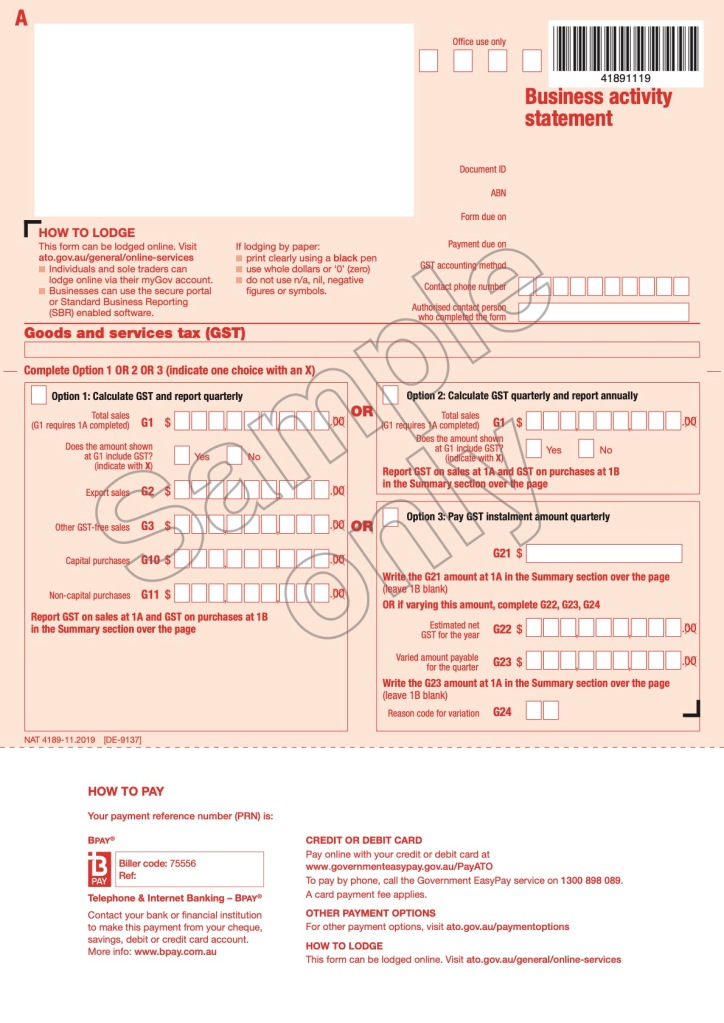

Then you get one of these forms in the mail:

You now have to calculate your BAS and send the form in (or send it via the Business Portal). Not hard to do, but still got to be done!

Based on this quarterly need, I've created a simple Google Sheet that I use to calculate any GST refunds or payments required for a quarter. This is done by entering in the Sales and Expenses into the Sheet, and selecting the Quarter for which the BAS form is.

The Sheet then tells you what to tick and enter in on the BAS paper.

Note: this form does not constitute financial advice. It should be used as guidance only and run by your registered tax agent/bookkeeper/CFO/whatever. This is simply something I have made and use in my own small businesses on occasion that I thought may be useful to share.

Another good free alternative can be Manager.io - "Manager is free accounting software for small business".